Government pension offset calculator

This calculator will help you determine if you are eligible for the beneficiary tax offset or seniors and pensioners tax offset. Once this is determined then a valuation date must be established.

The Government Pension Offset Gpo Top 7 Questions Social Security Intelligence

Eligibility for an Australian Government pension or allowance.

. You meet this condition if any of the following apply to your circumstances in 202122. The German government recently announced plans to reduce this to 48 by 2025. Seniors who meet these.

Our Pennsylvania retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income. CSRS Offset The FERS Retirement Annuity. How can I figure my Government Pension Offset.

The first thing that must be established is whether the pension is a defined benefit or a defined contribution plan. Before you use this calculator. Tax rates 2022-23 calculator.

If the offset is less than your Social Security benefits it is known as a partial Government Pension Offset. The upper limit for pension is 50 of the highest salary in the Government of India currently Rs 125000 per month. Access your super while you keep working.

Use the Beneficiary tax offset and seniors and pensioners tax offset calculator to help you work out your eligibility for this offset and calculate the offset amount. You filed for and were entitled to spouse widow or widower benefits before April 1 2004. Many CSRS annuitants are upset because they are being denied a full Social Security benefit in their retirement.

For example teachers and most safety personnel such as firefighters and police officers dont pay into Social Security. If you are CSRS Offset social security benefits may be subject to CSRS Offset at age 62. Under the Pensions Act 2008 every employer in the UK must put certain staff into a workplace pension scheme and contribute towards it.

This change would also eliminate the GPO and WEP offsets. Turn your super into a regular income stream. Super and pension age calculator.

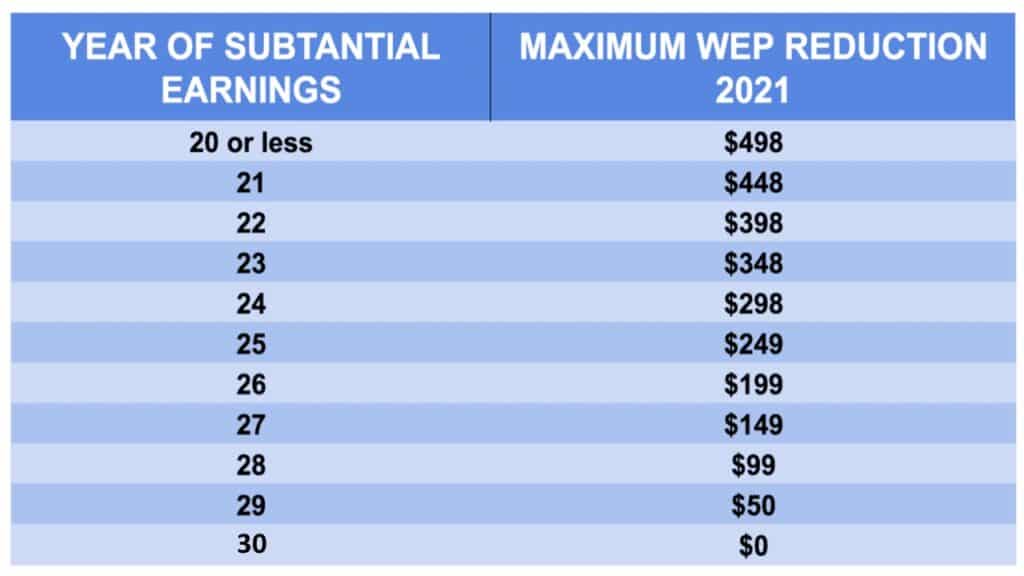

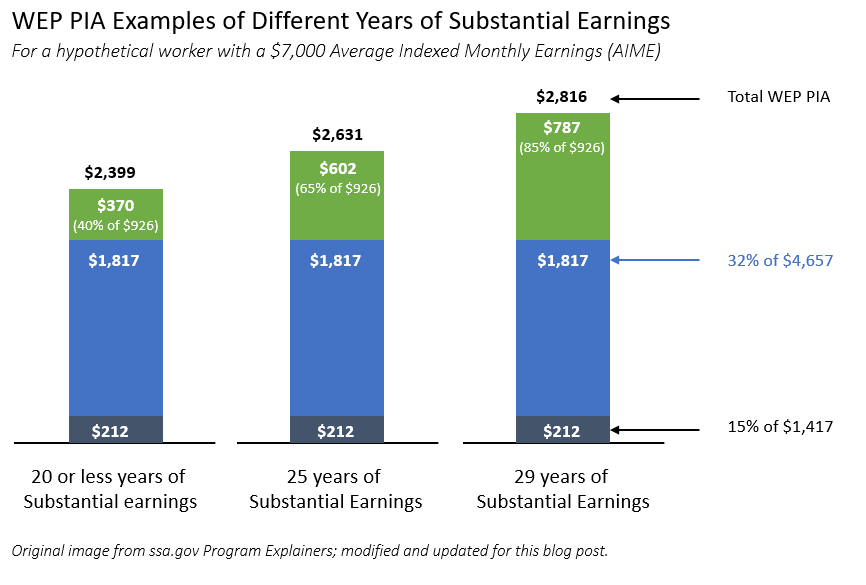

The WEP can reduce your benefit payment by as much as half the amount of your pension. You retire before age 55 unless you retire for disability or under the special provisions for law enforcement officers air traffic controllers and firefighters. The value of a defined contribution plan is simply the balance of the account as of a given date.

Your annual annuity will be reduced by one-sixth of 1 percent for each full month you are under age 55. Your government pension is not based on your earnings. However the characterization of the account community vs.

This is a link to the actual calculator that Social Security provides. However switching to the FERS Retirement Calculator system can provide them with full Social Security benefits including a FERS annuity. Use the GPO Online Calculator to calculate your estimated benefits as a spouse widow or widower.

It also exempts pension income for seniors 60 and older. The Bett3r Offset Account goes even further with helping you reach your goals. But if the government pension offset applies your Social Security spousal or survivor benefit will be reduced by two-thirds of your government pension.

A Central Government employee has an option to transfer a portion of the pension which does not exceed 40 into a lump sum payment. When you can access your super and the Age Pension. The SSA website offers a calculator to help you estimate a spouses or former spouses monthly benefits.

Super contribution caps 2021. You can pay up to 23712 a year into the plan 47424 for couples with 86 of contributions offset against tax rising to 100 by 2025. The pension is payable until the date of death included.

You can find a German pension calculator here from the OECD in English. It will then calculate the amount you are entitled to. If youre eligible to receive a pension from an employers who didnt withhold Social Security taxes from your earnings the Windfall Elimination Provision WEP and Government Pension Offset GPO may reduce your Social Security benefit.

SignatureSuper is an allocated pension account that helps you access your super as a regular income in retirement. Calculate how much the GPO could reduce your. The Social Security GPO Calculator.

Find out your income when you retire. If you employ at least one person you are an employer and you have certain legal duties. Perhaps the need of the hour is to formulate a National Offset Policy NOP aiming at overall economic development and industrial benefit using a whole of government approach and not just defence.

Use the Social Security Benefit calculator to calculate this input. The Government Pension Offset affects individuals who apply for Social Security spousal benefits. Some government pensions do not affect your benefit on your spouses record.

Your annuity will be reduced if. This is called automatic enrolment. For example if you have a government pension of 900 your Government Pension Offset is 600 900 x 23.

Tax rates 2021-22 calculator. If you are under the CSRS retirement plan not CSRS Offset its possible that you may have a social security benefit if you had worked at least 40 credits prior to your CSRS service. SAPTO Seniors and Pensioners Tax Offset The SAPTO is a special tax reduction available for senior Australians who are eligible for the Government Age or Service pension even though they may not have received a pension due to income or assets.

Separate property requires a detailed tracing. In addition to subsidized schemes there. Offset accounts can help you reduce the term and repayments on your home loan.

As with the WEP the formula for calculating GPO is complicated so its best to check with the SSA. The Windfall Elimination Provision may apply if you receive both a non-covered pension and Social Security retirement benefits. Get all the detail of its performance and download the fact sheets.

While property tax rates are fairly high here the average total sales tax rate is just 634. Beneficiary tax offset and seniors and pensioners tax offset calculator. The Government Pension Offset GPO fact sheet explains how your pension may affect your benefit on your spouses record.

Your government pension is from a federal Civil Service Offset state or local government job where you paid Social Security taxes. The amount of their spousal benefits will be reduced by two-thirds of their government pension. The Government Pension Offset applies if you get a government pension plus spousal or survivor benefits from Social Security.

Automatic enrolment - workplace pension duties. And at least one of the following applies. This means that your Social Security benefits will be reduced by 600.

The objectives of Indias defence offset policy need to be revisited to facilitate innovation-based transformation. Skip advert Then the GPO would kick in. Worcester Regional Retirement System 23 Midstate Drive Suite 106 Midstate Office Park Auburn MA 01501 Telephone.

Home loan repayments offset calculator Enjoy up to 5000 cashback when refinancing with us Apply to refinance your home loan with us by 30 September 2022 and settle by 31 December 2022 to receive up to 5000 cashback.

/GettyImages-1168040757-a6d3558ed29143169ae1081b749fc2e2.jpg)

11 Social Security Calculators Worth Your Time

Trs And Social Security It S Complicated Dearborn And Creggs

Social Security Offsets Lasers

What You Should Know About The Government Pension Offset Social Security Intelligence

Substantial Earnings For Social Security S Windfall Elimination Provision Social Security Intelligence

Trs And Social Security It S Complicated Dearborn And Creggs

How The Government Pension Offset And Windfall Elimination Provision Affects Dually Entitled Spouses Social Security Intelligence

Social Security Sers

What You Should Know About The Government Pension Offset Social Security Intelligence

Program Explainer Government Pension Offset

How Does Government Pension Offset Work Smartasset

How Does Government Pension Offset Work Smartasset

How To Calculate The Wep Gpo With Mixed Earnings Under The Same Retirement Plan Social Security Intelligence

Social Security And Your Calpers Pension Youtube

Social Security S Government Pension Offset Gpo A Common Sense Explanation

2

Program Explainer Government Pension Offset